Alternative Risk

Alternative Risk Structures

“Captives” — Privately Owned Insurance Companies

“Privately Owned Insurance Companies offer unparalleled benefits for the companies that use them. They allow a company to obtain insurance coverage that is tailored to its unique risks, rather than the standard coverages provided in commercial policies. Privately Owned Insurance Companies also allow a company’s risk to be judged on its own merit, rather than being charged a premium that is based on the risk of its entire industry. Privately Owned Insurance Companies also provide tax benefits for the companies who use them and often provide claims handling services that are substantially better than the service provided by commercial insurers.”

R. Wesley Sierk III, author of Taken Captive

What are Privately Owned Insurance Companies?

A privately owned insurance company is a closely-held insurance company established primarily to insure the risks of its parent company and affiliated groups. Day to day operations are controlled by the owners, who will also be the principal insureds. These operations include: Underwriting, policy placement, claims decisions, and investment policy and strategies for your insurance company.

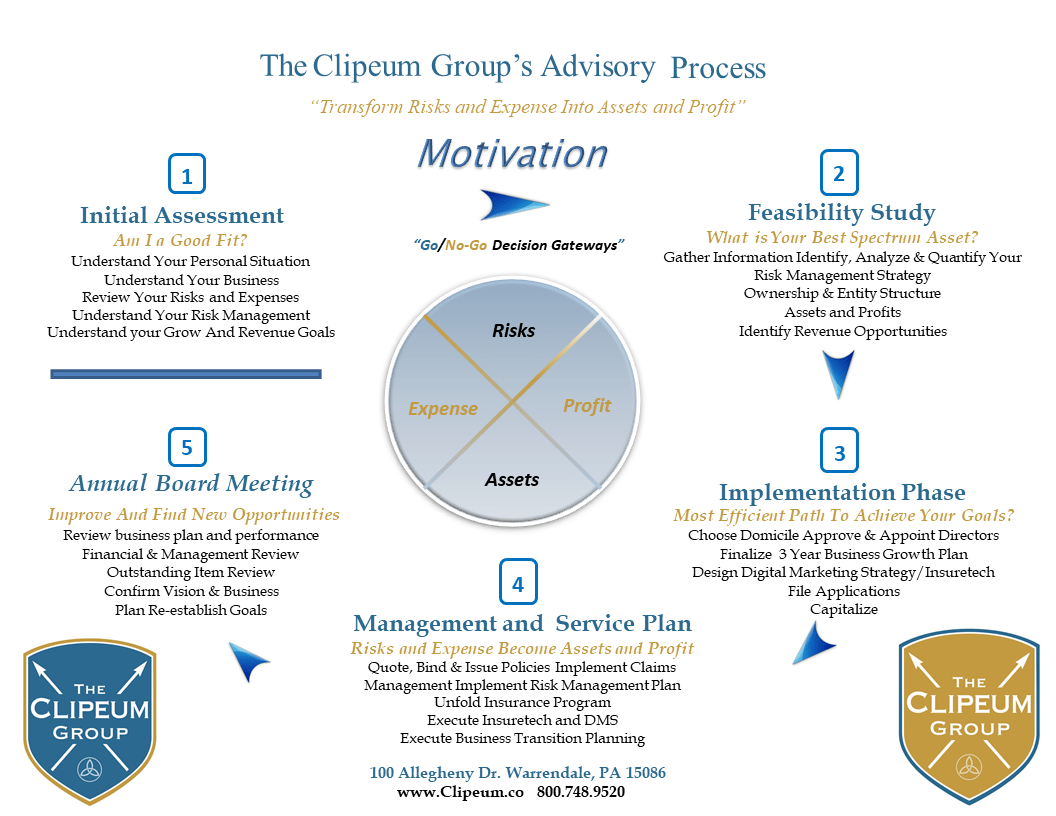

CLIPEUM GROUP’S ALTERNATIVE RISK, ASSESSMENT AND FEASIBILITY STUDY

There are many strategies and reasons to form a Captive, but they are not for just any situation. Our experienced team uses our “Decision Gateway” methodology to save time, and money, in order to assess the viability of your own insurance company, or other structure, the reasons to create one, and the implementation time and cost involved. We give decision makers the substantive information they need quickly, efficiently, in order to make decisive decisions… Go, or No-Go.

OUR ALTERNATIVE STRUCTURES TEAM

Clipeum Group’s Alternative Structures team is experienced in every aspect of creating, implementing, and managing Captives in order to achieve the insurance strategy, and the business strategies, of our clients. We are licensed in all 50 states. The Clipeum Group manages our Alternative Risk Solutions domiciled anywhere in the United States or internationally.

The Benefits Of Your Own, Private Insurance Company (“Captive”)

CoST ReDUCTIon/STaBILIzaTIon

Captives are often formed by insureds that have grown tired of the vagaries and undulations of the retail insurance market. Bypassing the retail insurance market can often lead to cost savings through the elimination or reduction of profit loads, broker commissions and administrative costs.

PRoVISIon of CoVeRage noT oTHeRWISe aVaILaBLe

Captives can often provide coverage for unique or specific risks that would not otherwise be transferable in the retail market.

CaPITaLIzIng on a BeTTeR THan aVeRage CLaIMS exPeRIenCe

Why subject yourself to the brutal rate making policies of commercial carriers? Often, the parent company is better served retaining the risk inside the captive as opposed to subsidizing the broader risk pool’s poor experience.

Tax TReaTMenT

Captives are able to accrue tax deductible reserves for unpaid claims, whether known or estimated.

aCCeSS To ReInSURanCe

A captive alone is subject to capacity limitations. However, captives can often access the reinsurance market to provide increased limits. Under certain circumstances, captives can offer more coverage than that which is available in the retail market.

ReCaPTURe UnDeRWRITIng PRofIT anD InVeSTMenT InCoMe

Hard markets can be extremely onerous on insurance buyers. Large premiums create a drag on parent company profitability. To a company with better than average claims experience this equates to a sunken cost, never to be recaptured. a captive can mitigate this burden. Underwriting profit and investment income that typically stays with commercial insurers can be recaptured by the parent company.

PRoVIDe CoVeRage foR STRaTegIC PaRTneRS

Assuming it is actuarially sensible, captives can write risks for industry peers, wholesalers, contractors or any other area where the traditional market’s rate is undesirable.

IMPRoVe RISk ManageMenT

Captives will positively influence operational behavior and enhance loss controls. The tremendous amount of data housed in the captive will help the parent company identify areas for improvement. Captives have traditionally been formed by companies seeking to recapture lost income due to high premium dollars. Subsidizing the poor claims of the larger risk pool or increasing retail insurer profits can create a drag on a company’s bottom line.